U.S. Motorcycle Shipping Statistics: Costs, Trends & Delivery Insights for 2026

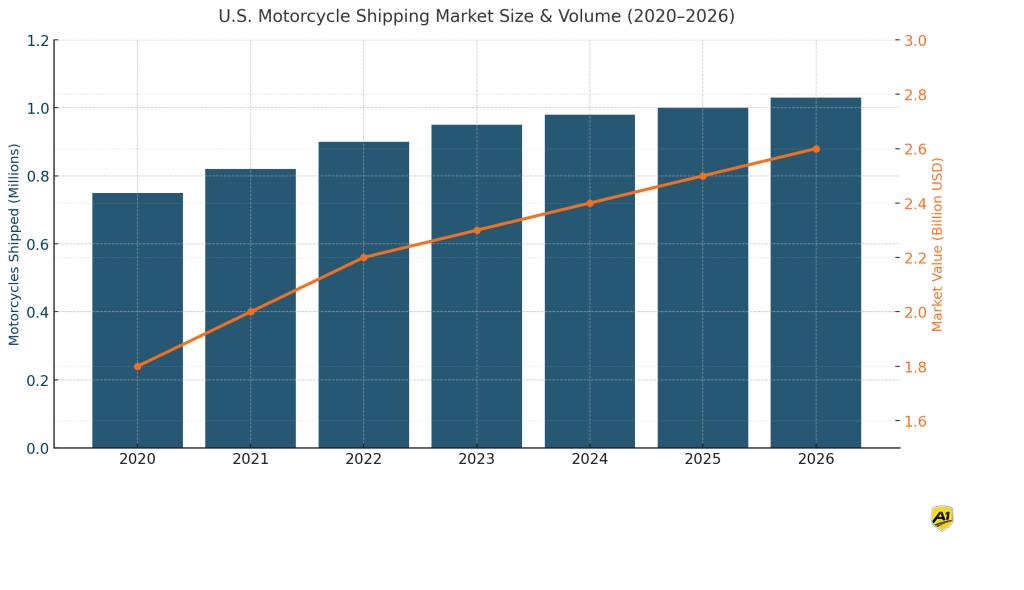

Motorcycle shipping has become an essential service in the U.S., supporting cross-country moves, online bike sales, and seasonal relocations. As of 2025, the motorcycle transport market was valued at approximately $2.5 billion, with an estimated 1 million motorcycles shipped annually for consumers, dealerships, and riders traveling for events . From interstate moves to international exports, the demand for motorcycle logistics continues to grow. This 2026 dataset outlines current costs, shipping times, safety benchmarks, industry challenges, and trends shaping the future of motorcycle transport.

U.S. Motorcycle Shipping Market Size & Demand Trends

The U.S. motorcycle shipping industry remains a high-demand, multi-billion-dollar market. In 2025, it was valued at approximately $2.5 billion, with around 1 million motorcycles shipped annually for both personal and commercial purposes. Growth is driven by rising motorcycle ownership, relocation trends, direct-to-consumer motorcycle sales, and an increasing number of long-distance rallies and tourism events.

According to industry forecasts, the motorcycle transport market is projected to grow at a compound annual growth rate (CAGR) of roughly 3% through 2033, indicating steady expansion. Global projections also support this trend, with the worldwide motorcycle shipping market expected to reach $11.8 billion by 2027, reflecting strong international logistics demand for motorcycles and powersports vehicles.

Average Cost to Ship a Motorcycle in 2026

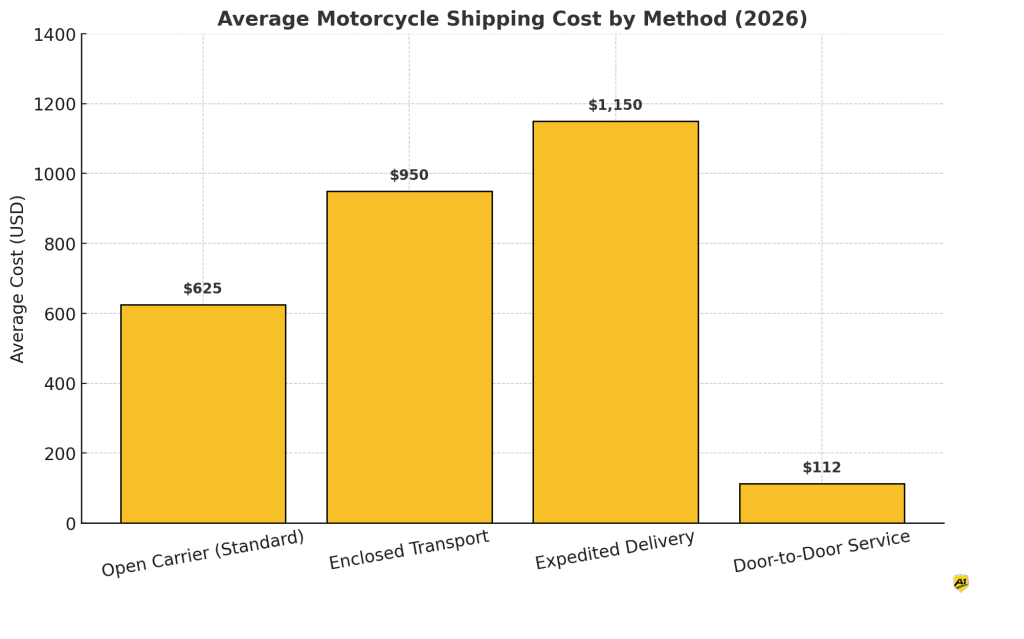

In 2026, the average cost to ship a motorcycle within the United States ranges from $350 to $950, depending on factors such as distance, transport type, delivery speed, and fuel surcharges. Open carrier transport remains the most commonly used method due to its cost efficiency, while enclosed transport continues to serve riders looking for enhanced protection.

| Shipping Type | Average Cost (USD) | Estimated Transit Time |

| Open Carrier (Standard | $500 – $750 | 5–10 business days |

| Enclosed Transport | $700 – $1,200 | 4–8 business days |

| Expedited Delivery | $900 – $1,400 | 2–4 business days |

| Door-to-Door Service | +$75 – $150 (surcharge) | Varies by location |

Shipping costs have seen a moderate year-over-year increase of approximately 6–8%, driven by national fuel trends and insurance adjustments. Pricing is generally higher in urban corridors, during peak seasons, and for cross-country or specialty routes. Most licensed carriers include limited liability insurance, with coverage often ranging from $10,000 to $15,000 per unit.

Shipping Methods | Open, Enclosed, Crated, and Freight

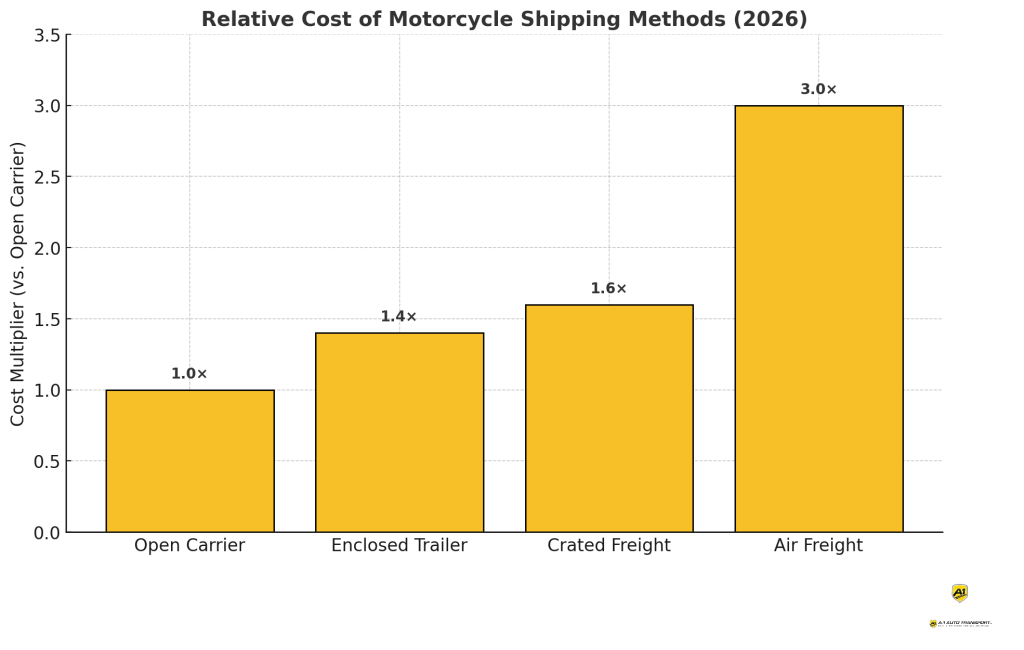

Motorcycles are shipped using a variety of methods depending on distance, value of the bike, weather sensitivity, and destination. In the United States, the most commonly used options include open and enclosed trailer transport, while international or specialty moves often involve crated or freight-based shipping.

Open carrier transport remains the most popular and affordable option, especially for short- to mid-range domestic hauls. However, enclosed trailers are preferred for high-value motorcycles, vintage models, and cross-country shipments where exposure to weather or road debris is a concern. Enclosed shipping typically adds 30–50% to the cost but offers full shielding during transit.

For motorcycles moving overseas or requiring extra stabilization, crated shipping is used. The motorcycle is strapped and blocked within a wooden or steel crate to reduce movement risk and meet freight compliance standards. This method is also common when multiple bikes are being shipped in consolidated loads.

In rare cases, air freight is used for urgent shipments or international events but is significantly more expensive. Most international motorcycle moves are handled via ocean freight, either containerized or roll-on/roll-off, with transit times ranging from 4 to 8 weeks depending on destination.

Overall, truck-based shipping dominates the U.S. market, while maritime and crated solutions play a growing role in international logistics and specialized handling.

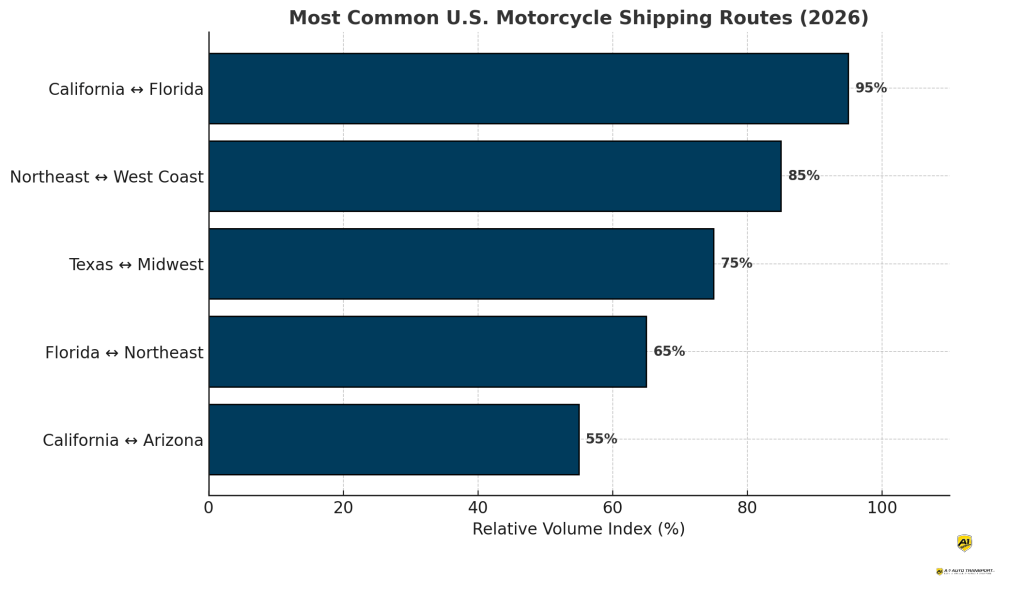

Domestic Shipping Routes & Seasonal Trends

Motorcycle shipping in the U.S. follows distinct regional and seasonal patterns, shaped by rider behavior, climate, and relocation cycles. The highest shipping volumes are consistently seen along coast-to-coast corridors, as well as between the Midwest and Sunbelt states.

States such as California, Florida, and Texas account for a significant share of domestic motorcycle shipments. These regions not only have the largest motorcycle registration counts but also serve as year-round riding destinations, especially during winter months when northern states experience harsh weather.

There is also a seasonal pattern driven by “snowbird” migration, where thousands of riders transport their motorcycles south each fall and return north in the spring. Additionally, event-driven demand peaks during late spring and summer. Notable spikes in shipping volume are recorded around major motorcycle rallies, including Daytona Bike Week (March) and the Sturgis Motorcycle Rally (August). During these months, enclosed and expedited transport services are in higher demand, often requiring advance scheduling.

Shippers operating in high-demand corridors tend to offer more flexible pickup windows and faster delivery times. In contrast, rural or low-volume lanes may involve delays while carriers consolidate loads or reroute equipment.

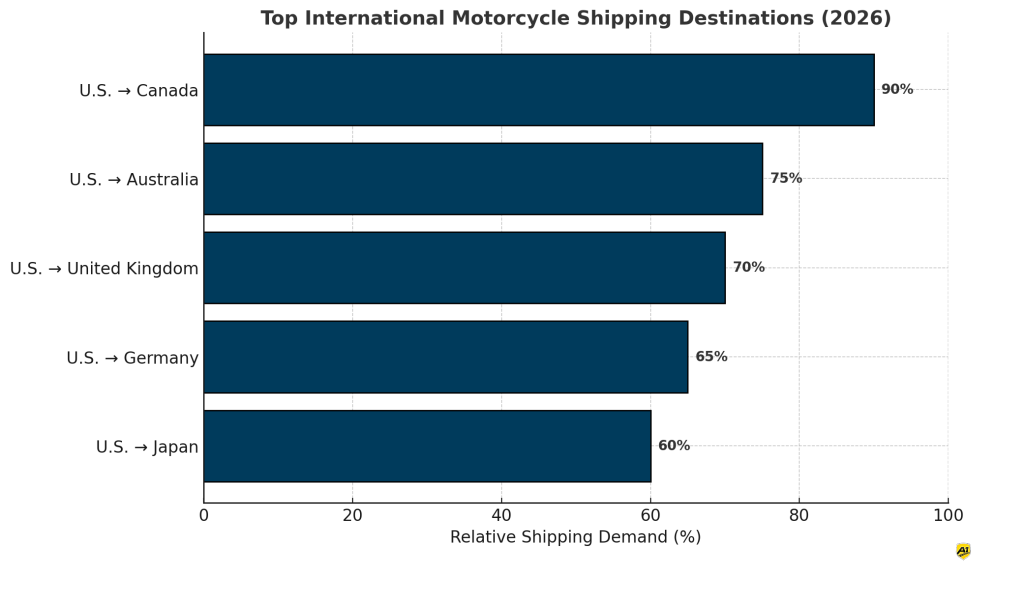

International Motorcycle Shipping Trends (2026)

International motorcycle shipping continues to grow as American riders increasingly relocate abroad, purchase specialty bikes overseas, or participate in international rallies and tours. The most active shipping routes in 2026 include exports from the U.S. to Canada, Australia, the United Kingdom, and Germany, as well as inbound shipments from Japan and the European Union.

Among these, Canada remains the top international destination, due to proximity and ease of overland or short-haul ocean freight. Australia and select EU countries have seen a rise in U.S. motorcycle imports, largely driven by collector purchases and touring demand.

Ocean freight remains the primary mode of international transport. Most motorcycles are shipped in 20- or 40-foot containers, either individually crated or as consolidated loads. Transit times range from 4 to 8 weeks depending on the port of origin and customs clearance processes. Crated shipping is often required to comply with hazardous goods regulations involving fuel systems and lithium-ion batteries.

The United States remains the largest global importer of motorcycles by value, with $3.99 billion in motorcycle imports recorded in 2024, largely from Japan, China, and Germany. Although import volumes dipped slightly due to broader freight slowdowns, the segment continues to show long-term stability.

Military relocations, international job transfers, and destination tourism are all contributing to sustained demand for overseas motorcycle transport going into 2026.

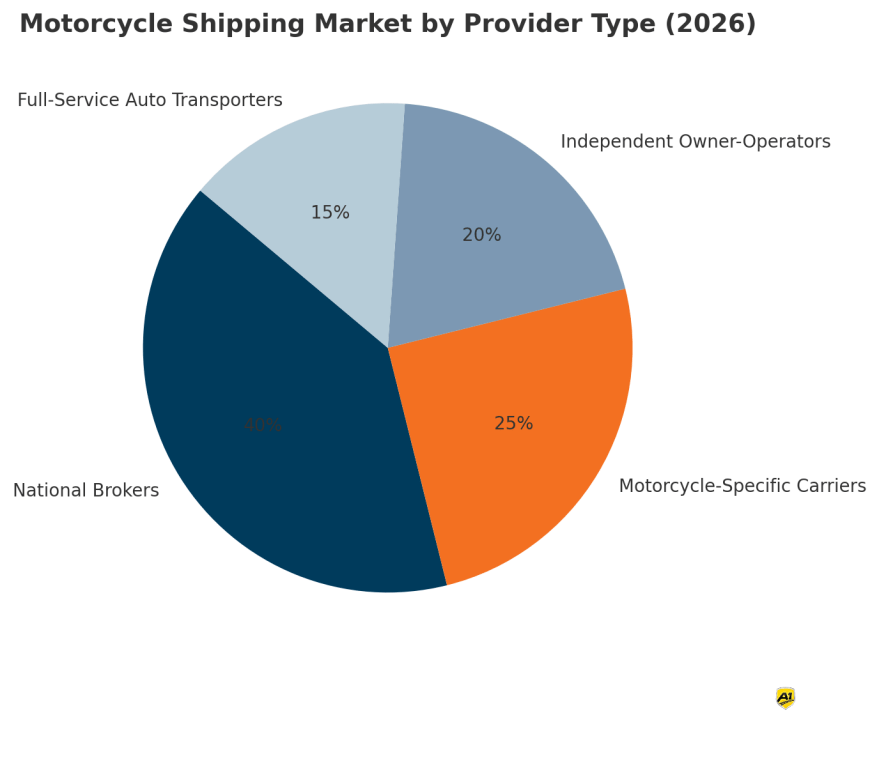

Motorcycle Transport Companies & Market Structure

The U.S. motorcycle shipping industry is composed of a mix of brokers, carriers, and hybrid logistics firms operating across regional and national networks. While the market remains largely fragmented, a handful of high-volume providers have emerged with nationwide reach and established reputations.

Most motorcycle shipments are coordinated by brokers, companies that match customer requests with independent carriers. These brokers typically maintain databases of vetted drivers and freight providers, allowing them to handle routes across all 50 states. Some of the largest brokers in this space, such as Montway Auto Transport, uShip, and AmeriFreight, offer motorcycle shipping services alongside general vehicle logistics.

A smaller segment of the market consists of motorcycle-specific carriers, such as HaulBikes, that operate their own fleets of enclosed trailers and focus exclusively on two-wheel transport. These companies often emphasize secure handling, seasonal route scheduling, and personalized support for high-value bikes.

Industry estimates suggest that hundreds of licensed vehicle transport companies in the U.S. offer motorcycle shipping as part of their service mix. The market generates approximately $2 billion in annual motorcycle transport revenue, with an average of 1 million units moved per year. Despite this scale, competition remains high due to low barriers to entry and a reliance on freelance carrier capacity.

Technology plays a growing role in market differentiation. Many of the top brokers now provide instant online quoting, real-time GPS tracking, digital proof-of-delivery, and access to verified customer reviews, all of which contribute to trust and transparency in the booking process.

Going into 2026, the motorcycle transport market is expected to remain competitive, with continued growth driven by relocation trends, online vehicle sales, and cross-border shipping needs.

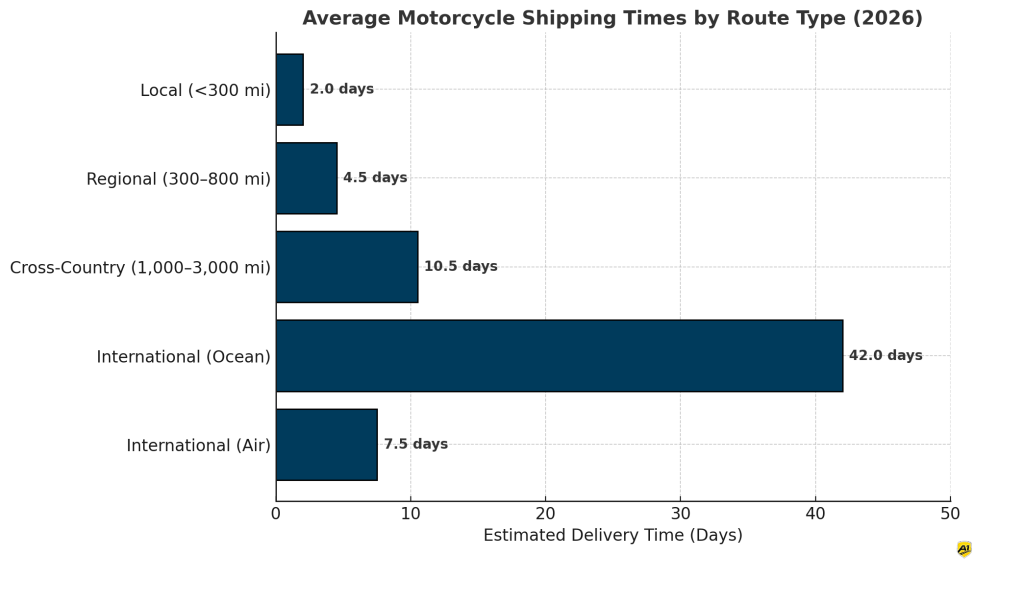

Average Motorcycle Shipping Times & Distances

Motorcycle delivery timeframes in 2026 vary by distance, route saturation, and time of year. Most domestic shipments fall within a 5 to 10 business day window, with faster turnaround on high-volume corridors. International moves require substantially longer lead times.

- Average domestic delivery time: 5–10 business days

- Local shipments (<300 miles): typically delivered in 1–3 days

- Regional moves (300–800 miles): average 3–6 days

- Cross-country hauls (1,000–3,000 miles): 7–14 days depending on routing

- Pickup windows typically range from 48 to 72 hours

- Major corridors (e.g. CA↔FL, TX↔NY) benefit from faster carrier availability

- International ocean freight shipments: 4–8 weeks door to door

- Air freight: used rarely, but completes in 5–10 days including customs

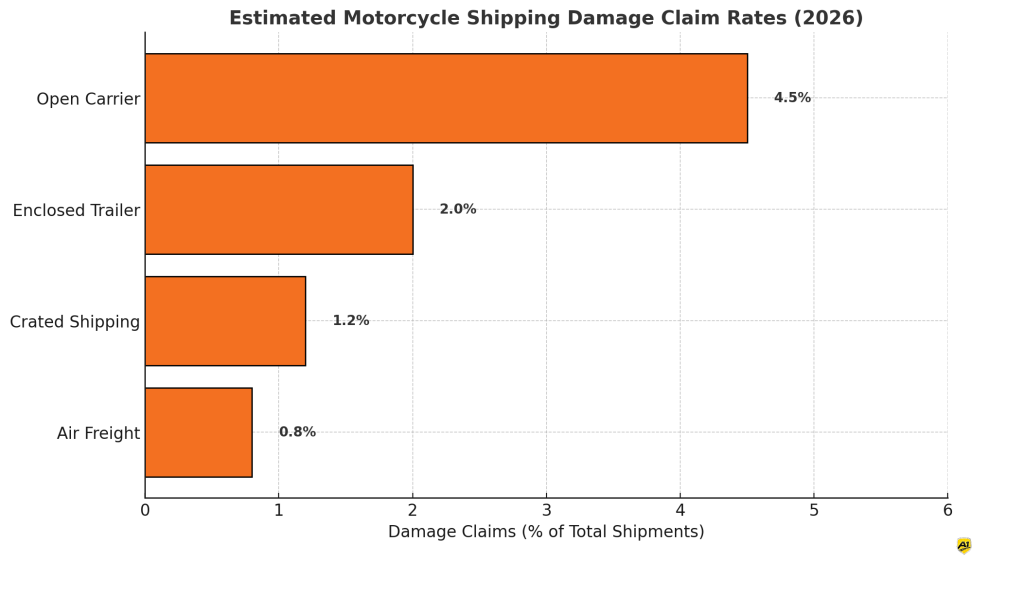

Damage Rates, Safety, and Insurance Claims

Motorcycle shipping requires careful handling, particularly due to the exposed and lightweight nature of the vehicles. While most shipments are completed without issue, damage incidents do occur, making insurance coverage and professional carriers critical in 2026.

- Most motorcycle shipments are completed without reported damage

- FMCSA data showed a 12% increase in vehicle transport incidents in 2024

- Common risks include scratches, tipping, or frame misalignment if poorly secured

- Average repair cost for mid-range motorcycles: $5,000 to $15,000

- Base carrier liability typically covers $10,000 to $15,000 per load

- Top-tier providers offer up to $1M in cargo insurance as part of their service

- Damage claims are more frequent during long-distance or winter routes

- Crated or enclosed shipping significantly reduces exposure-related damage risk

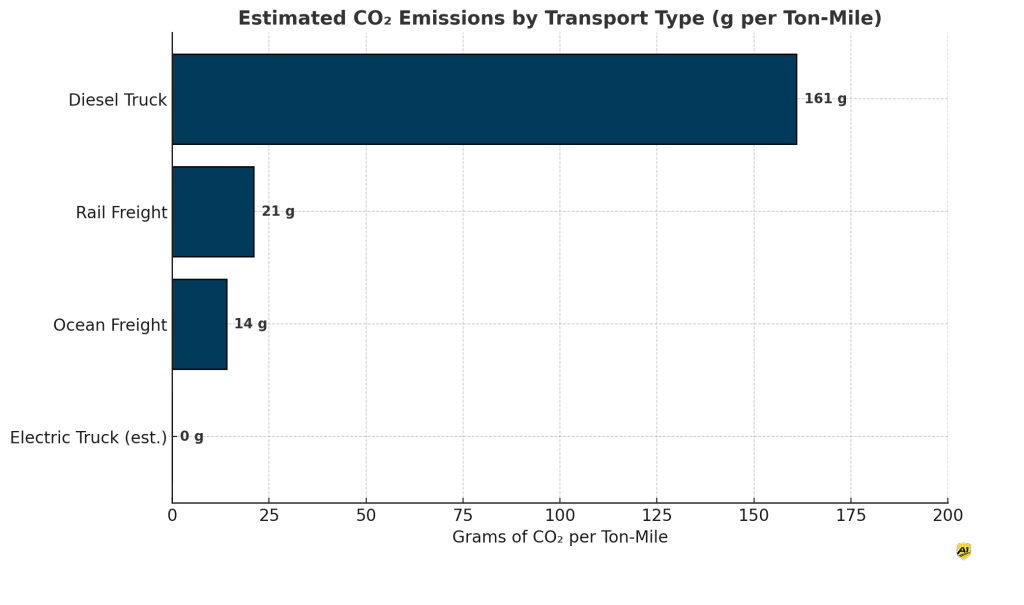

Industry Challenges & Environmental Impact

The motorcycle transport sector in 2026 faces operational and environmental pressures that directly impact cost, delivery times, and long-term sustainability. These challenges affect both carriers and customers nationwide.

- Fuel costs remain volatile, with diesel averaging over $4.00/gallon in early 2026

- Heavy-duty transport trucks operate at 5–7 miles per gallon, increasing per-mile cost

- The U.S. trucking industry remains short over 60,000 qualified drivers

- Delays from labor shortages and port congestion affect peak-season shipments

- Transport rigs contribute to 23% of all transportation-sector GHG emissions

- Most shipments rely on diesel trucks; EV freight rigs still make up <0.3% of the fleet

- Government programs offer up to $40,000 in EV truck tax credits to encourage adoption

- Crated shipments must comply with EPA safety rules for hazardous materials, including drained fuel and secured batteries

While infrastructure is improving, sustainable transport options remain limited. Most carriers are focusing on load consolidation, route optimization, and digital scheduling to reduce idle miles and fuel consumption.

Future Outlook for Motorcycle Transport

The motorcycle shipping industry is expected to see moderate growth beyond 2026, shaped by digital transformation, rising consumer expectations, and evolving environmental standards. Demand will remain stable, with key improvements driven by operational efficiency and technology.

- Market growth projected at ~3% CAGR through 2030, following steady shipping volume

- Online vehicle marketplaces are increasing long-distance bike purchases, requiring transport

- Digital tools such as GPS tracking, automated quotes, and shipment status updates are now standard

- AI-driven route optimization is reducing carrier idle time and fuel consumption

- Consolidation among national brokers and regional carriers is expected to improve pricing and service consistency

- Electrification of transport fleets is underway, though adoption is still in early stages

- Regulatory pressure on emissions may lead to mandatory fuel efficiency targets in the freight sector

- Cross-border shipping is likely to increase, especially to Canada, the EU, and Australia

While the core service model of motorcycle transport remains stable, future gains will depend on automation, sustainability, and stronger consumer logistics infrastructure.

Share on Facebook

Share on Facebook Share on LinkedIn

Share on LinkedIn Share on Twitter

Share on Twitter Google

Google  Instagram

Instagram