U.S. Boat & Yacht Shipping Statistics (2026)

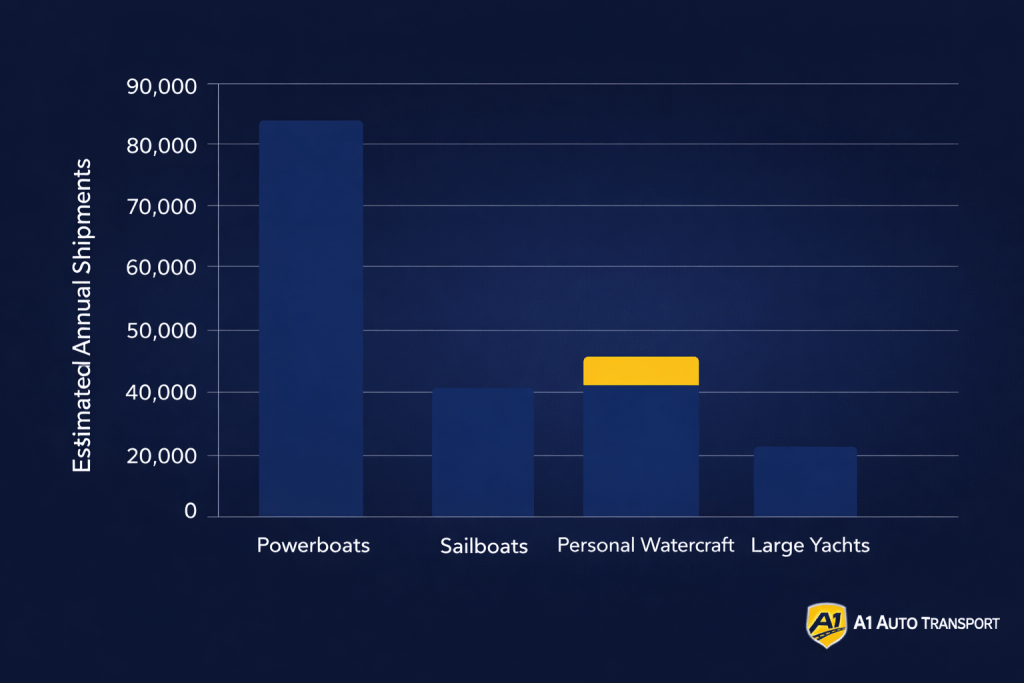

U.S. Boat & Yacht Shipping Volume

The United States has one of the largest recreational boating markets in the world, which directly drives annual boat and yacht transport activity across domestic and international routes. Shipping volume is influenced by resale transactions, seasonal relocation, marina-to-marina transfers, and cross-border trade. This dataset reflects aggregated U.S. boat and yacht shipping data observed across recent years.

- The U.S. Coast Guard reports over 12 million registered recreational vessels, forming the base population for annual transport demand across states and ports.

- Industry transaction data shows more than 1 million used boats change ownership each year, with interstate shipping commonly required for long-distance or non-local sales.

- Domestic transport activity is dominated by powerboats, which account for roughly 70% to 80% of all shipped recreational vessels, followed by personal watercraft and sailboats.

- Large yachts represent a smaller share by unit count, but contribute disproportionately to shipping activity due to specialized carriers, escort requirements, and waterborne transport methods.

- Seasonal patterns are consistent nationwide, with spring and fall accounting for the highest shipping volumes, reflecting northern launch seasons and winter relocation toward southern states.

- Coastal and warm-weather states generate the highest shipment density, with Florida, California, and Texas repeatedly ranking as top origin and destination states for boat transport activity.

This volume profile reflects a fragmented transport ecosystem spanning private carriers, marinas, dealerships, and international freight operators rather than a centralized reporting system.

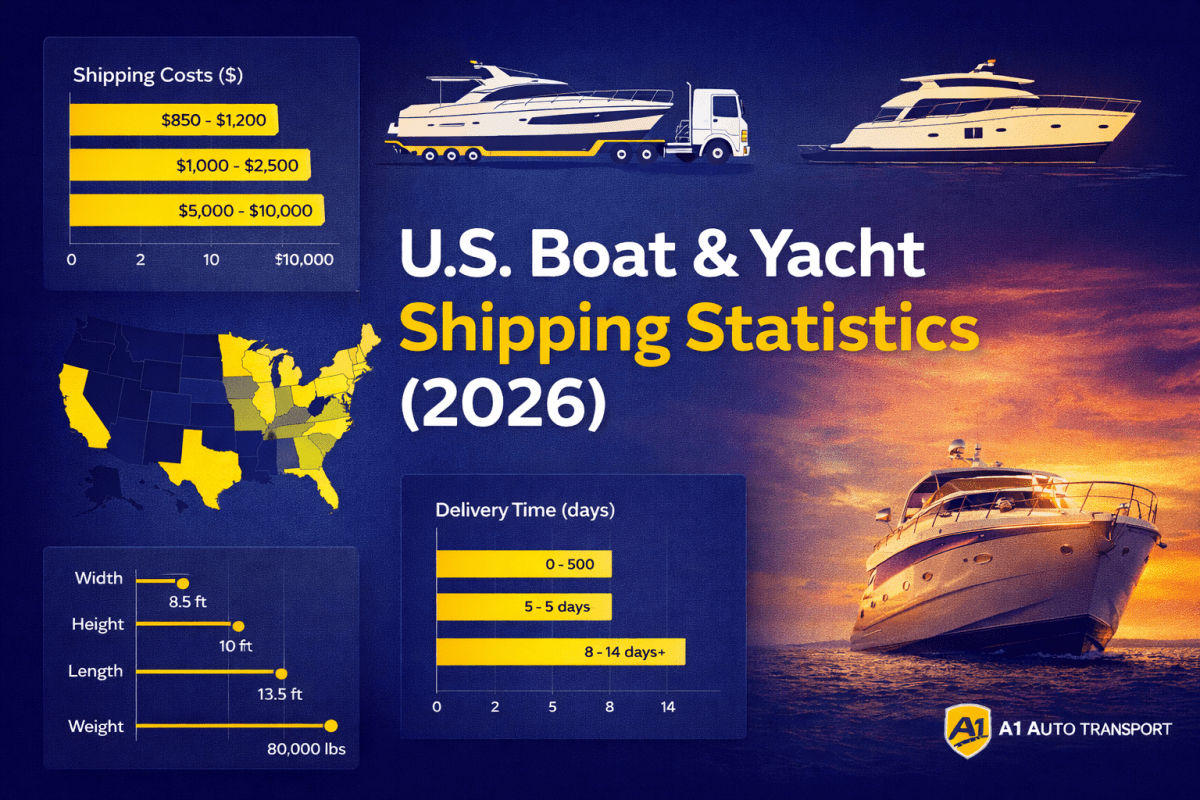

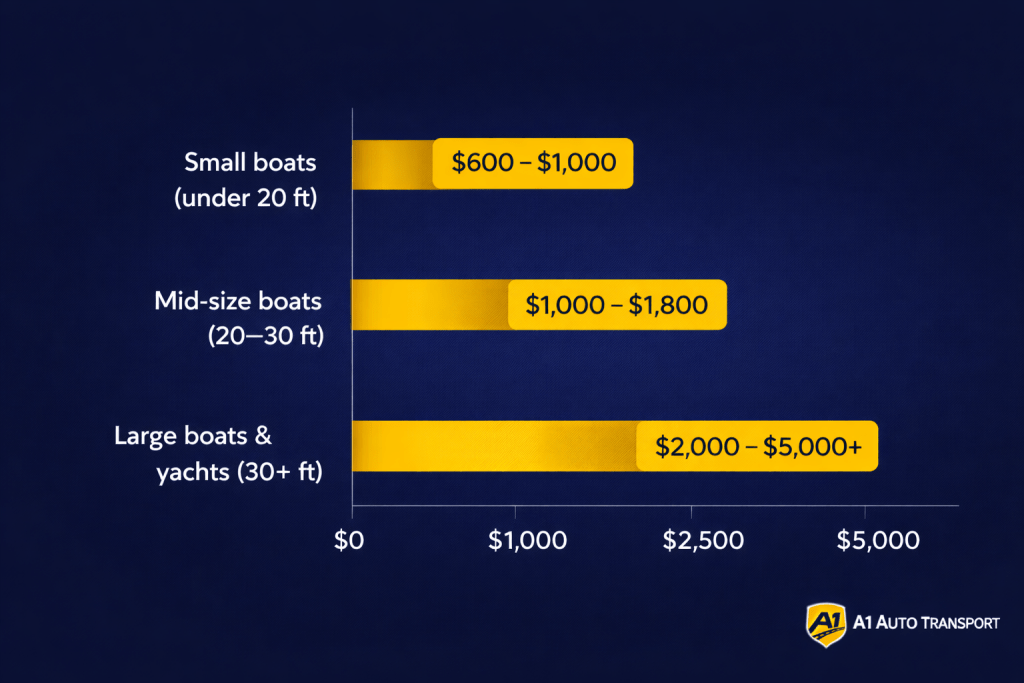

Average Boat & Yacht Shipping Costs in the U.S.

Boat and yacht shipping costs in the United States vary primarily by vessel size, transport method, distance, and permitting requirements. Unlike standardized freight markets, recreational vessel transport pricing is range-based due to route variability and specialized handling needs.

- Average domestic boat shipping costs typically range from $600 to $2,500, depending on distance, boat length, and trailer requirements.

- Smaller boats under 20 feet transported regionally often fall within the $600 to $1,000 range for short-haul moves.

- Mid-size boats between 20 and 30 feet commonly ship within a $1,000 to $1,800 range for interstate transport.

- Large boats and yachts over 30 feet frequently exceed $2,000 to $5,000+, reflecting escort vehicles, permits, and specialized cradles.

- Cost per mile generally declines with distance, with short hauls averaging $1.25 to $2.00 per mile, while long-distance shipments often fall between $0.50 and $0.85 per mile.

- Water-based yacht transport methods, such as lift-on/lift-off shipping, carry higher total costs but reduce operational wear compared to overland towing.

Pricing variability is influenced by federal and state transport regulations, fuel costs, route congestion, and seasonal demand, rather than fixed national rate structures.

Boat & Yacht Shipping Costs by Distance

Distance is one of the strongest cost drivers in U.S. boat and yacht transport. While total shipment price increases with mileage, the average cost per mile typically declines as distance increases due to route efficiency and carrier consolidation.

- Boat shipments under 500 miles commonly fall within a total cost range of $600 to $900, reflecting higher per-mile rates on short hauls.

- Mid-range shipments between 500 and 1,000 miles typically average $800 to $1,200, depending on vessel size and trailer configuration.

- Long-distance moves exceeding 1,000 miles often range from $1,100 to $1,600+, particularly for coast-to-coast or multi-state routes.

- Average per-mile transport costs generally decline from $1.25–$2.00 per mile on short routes to $0.50–$0.85 per mile on long-distance shipments.

- Larger boats and yachts experience wider cost variability across all distance bands due to permitting, escort vehicles, and height or width restrictions.

- Seasonal demand can temporarily increase long-haul pricing during peak spring and fall transport periods, especially on north–south routes.

Distance-based pricing patterns remain consistent across overland transport markets and are influenced by fuel efficiency, carrier backhauls, and regulatory requirements rather than fixed national rate tables.

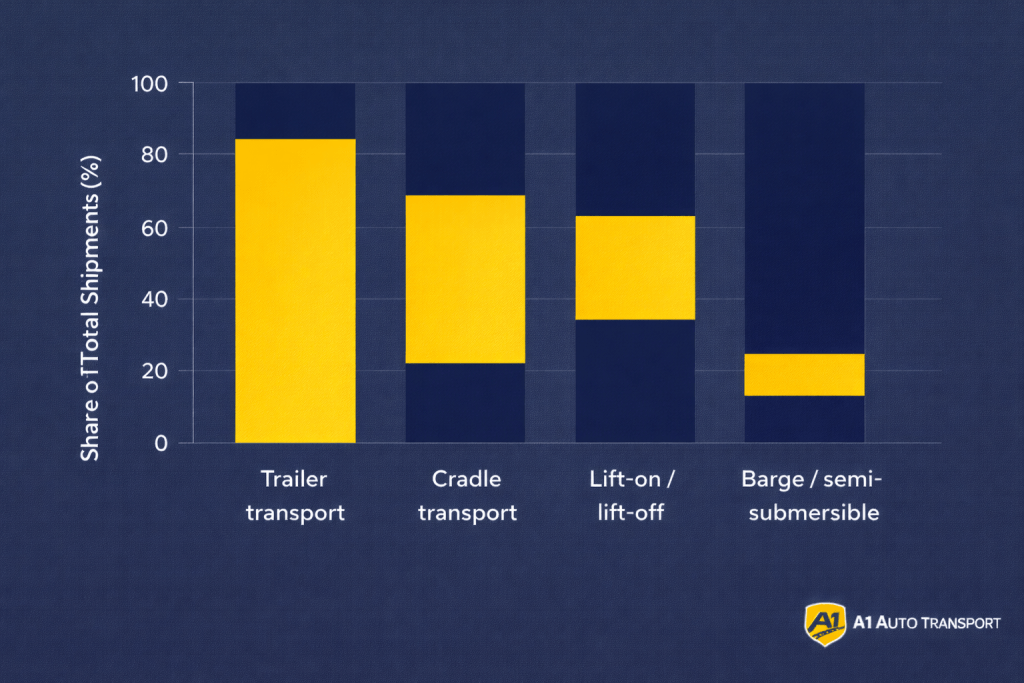

Common Boat & Yacht Transport Methods in the U.S.

Boat and yacht transport in the United States relies on several distinct shipping methods, selected based on vessel size, distance, route accessibility, and regulatory constraints. Method choice directly affects cost, delivery time, and handling requirements.

- Overland trailer transport is the most common method for small and mid-size boats, accounting for the majority of domestic shipments under 30 feet.

- Overland cradle transport is frequently used for larger boats that cannot travel on their own trailers, particularly vessels exceeding standard width limits.

- Lift-on / lift-off water transport is commonly used for yachts and large vessels traveling between coastal regions or international ports, reducing mechanical wear during long relocations.

- Barge and semi-submersible vessel transport is primarily reserved for large yachts and specialty moves, especially for international or seasonal repositioning.

- Trailer-based shipments dominate short and mid-range routes, while water-based methods become more common as vessel size and distance increase.

- Oversize regulations, bridge clearances, and state permitting requirements significantly influence method selection for boats over 10 feet wide or 13.5 feet tall.

Transport method distribution reflects logistical practicality rather than preference, with regulatory thresholds serving as the primary decision points.

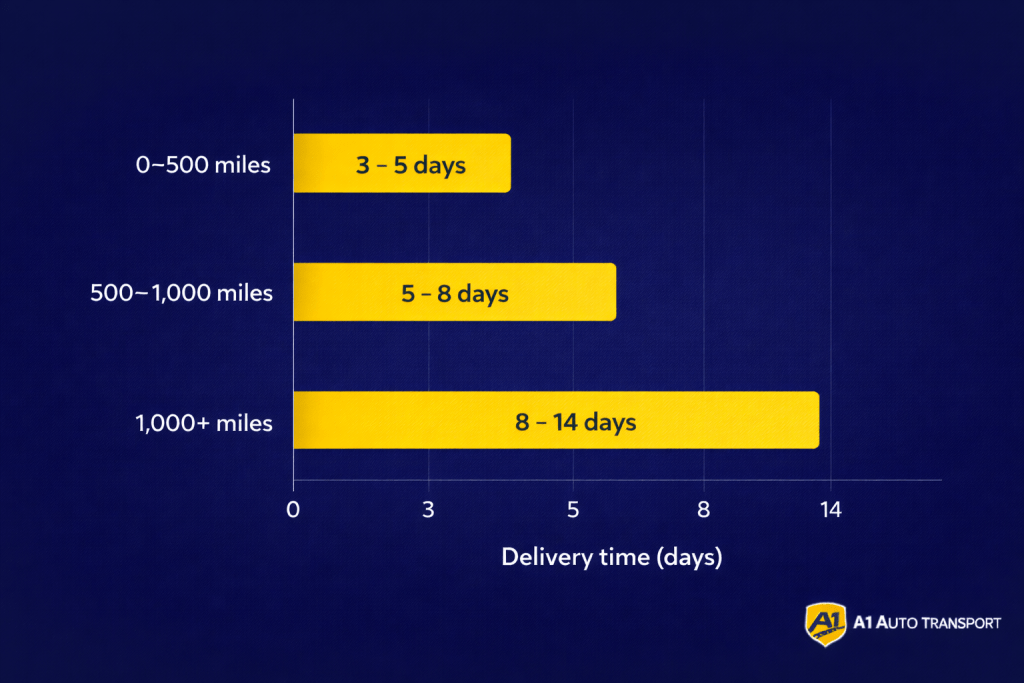

Boat & Yacht Shipping Delivery Timeframes

Delivery timelines for boat and yacht shipping in the United States vary based on distance, transport method, route congestion, and regulatory requirements. Unlike parcel or vehicle shipping, vessel transport timelines are expressed as ranges due to permitting and scheduling constraints.

- Short-distance boat shipments under 500 miles are commonly completed within 3 to 5 days, including loading and unloading time.

- Mid-range shipments between 500 and 1,000 miles typically take 5 to 8 days, depending on routing efficiency and carrier availability.

- Long-distance shipments exceeding 1,000 miles often require 8 to 14 days, particularly for coast-to-coast or multi-state routes.

- Overland trailer transport generally offers faster transit times than cradle-based or oversize moves, which require additional permits and escorts.

- Water-based yacht transport timelines are longer but more predictable, as vessels move according to fixed port schedules rather than highway routing.

- Seasonal demand during spring and fall can extend delivery timelines due to higher shipment volumes and limited carrier availability.

Transit time variability reflects logistical constraints rather than service quality differences, making range-based timelines the most reliable dataset representation.

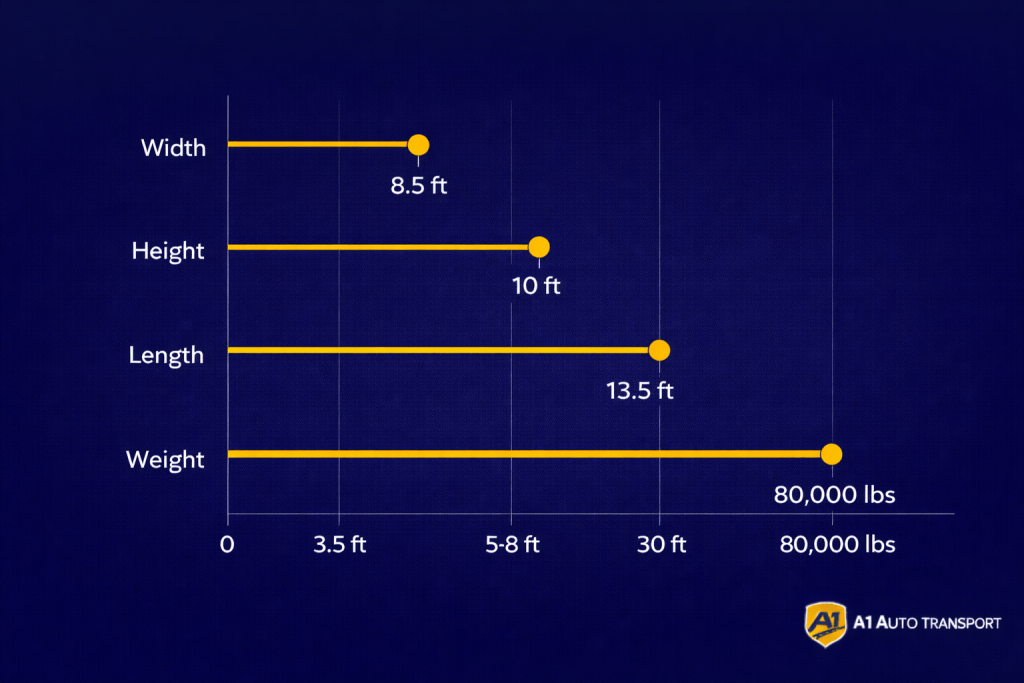

Boat Size, Weight, and Transport Regulation Thresholds

Boat and yacht transport in the United States is heavily influenced by size, weight, and dimensional thresholds that trigger additional permitting and escort requirements. These regulatory breakpoints play a direct role in routing, cost, and delivery timelines.

- Boats exceeding 8.5 feet in width typically require oversize permits for interstate overland transport.

- Vessels wider than 10 feet often require route surveys and, in some states, escort or pilot vehicles.

- Boats taller than 13.5 feet when loaded commonly face bridge clearance restrictions, increasing route complexity and transit time.

- Total transport weight above 80,000 pounds may require additional federal or state-level approvals depending on axle configuration.

- Boats over 30 feet in length are significantly more likely to require cradle transport rather than standard trailer setups.

- Large yachts exceeding 40 feet frequently transition from overland transport to water-based methods due to regulatory and logistical constraints.

These thresholds create step-changes in transport complexity rather than linear cost increases, making size-based classification a critical factor in vessel shipping logistics.

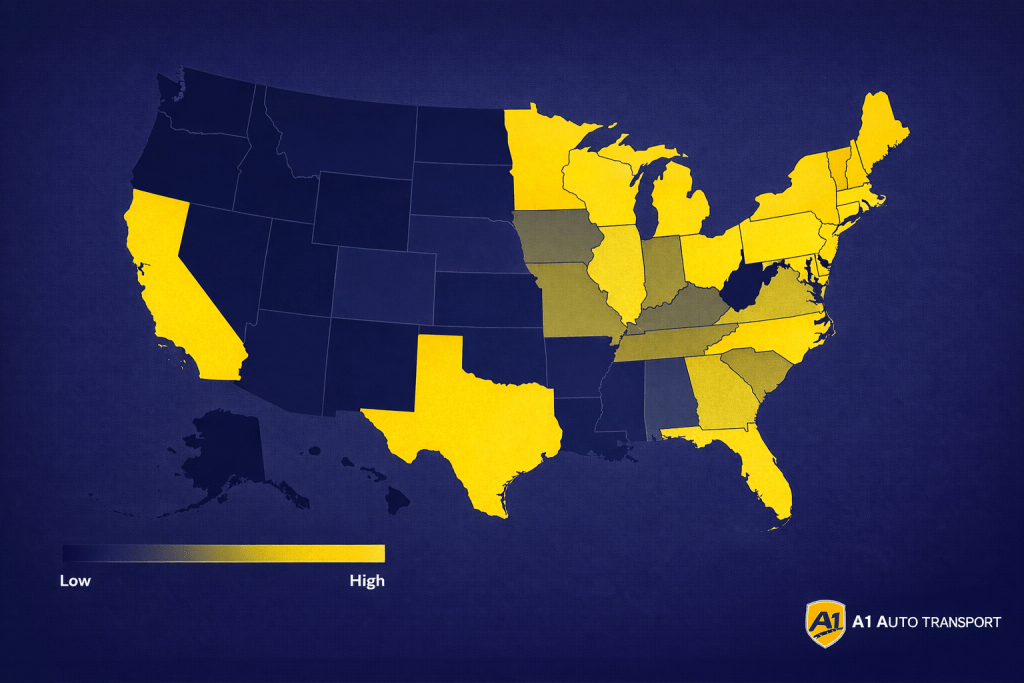

State-Level Boat & Yacht Shipping Activity in the U.S.

Boat and yacht shipping activity in the United States is geographically concentrated, reflecting vessel ownership density, coastal access, and seasonal migration patterns. State-level shipment volume is driven more by boating infrastructure and climate than population size alone.

- Florida consistently ranks as the highest-volume state for boat and yacht shipments, serving as both a major origin and destination due to year-round boating and winter relocation demand.

- California and Texas follow closely, supported by extensive coastlines, large inland waterways, and high recreational boat ownership.

- Northern states experience seasonal outbound spikes, particularly during fall months as boats relocate south for winter storage or use.

- Inland states with large freshwater lakes, such as Michigan and Arizona, generate notable transport activity despite limited coastal access.

- Coastal states account for a disproportionate share of yacht transport activity, especially vessels requiring water-based or lift-on / lift-off methods.

- Interstate boat shipping is more common than intrastate transport for larger vessels, reflecting limited local marina availability for oversized boats.

State-level distribution highlights the role of climate, marina density, and navigable waterways in shaping national boat transport flows.

Key Takeaways

- The U.S. boat and yacht shipping market is driven by a large installed base of recreational vessels, with transport demand closely tied to resale activity and seasonal relocation patterns.

- Shipping costs vary widely and are best represented as ranges rather than fixed prices, reflecting differences in vessel size, distance, transport method, and regulatory complexity.

- Distance strongly influences total shipment cost, while average cost per mile consistently declines on longer routes due to logistical efficiencies.

- Transport method selection shifts from trailer-based hauling to cradle and water-based shipping as vessel size and regulatory thresholds increase.

- Delivery timelines are best expressed in multi-day ranges, with permitting, routing constraints, and seasonal demand playing a greater role than pure mileage.

- State-level shipping activity is concentrated in coastal and warm-weather states, particularly Florida, California, and Texas, underscoring the influence of climate and boating infrastructure on transport flows.

Share on Facebook

Share on Facebook Share on LinkedIn

Share on LinkedIn Share on Twitter

Share on Twitter Google

Google  Instagram

Instagram